1. Revenue Hotspots and Marketing Strategy

Analysis of revenue and occupancy metrics to pinpoint the most financially successful market segments.

Detailed Analysis Breakdown

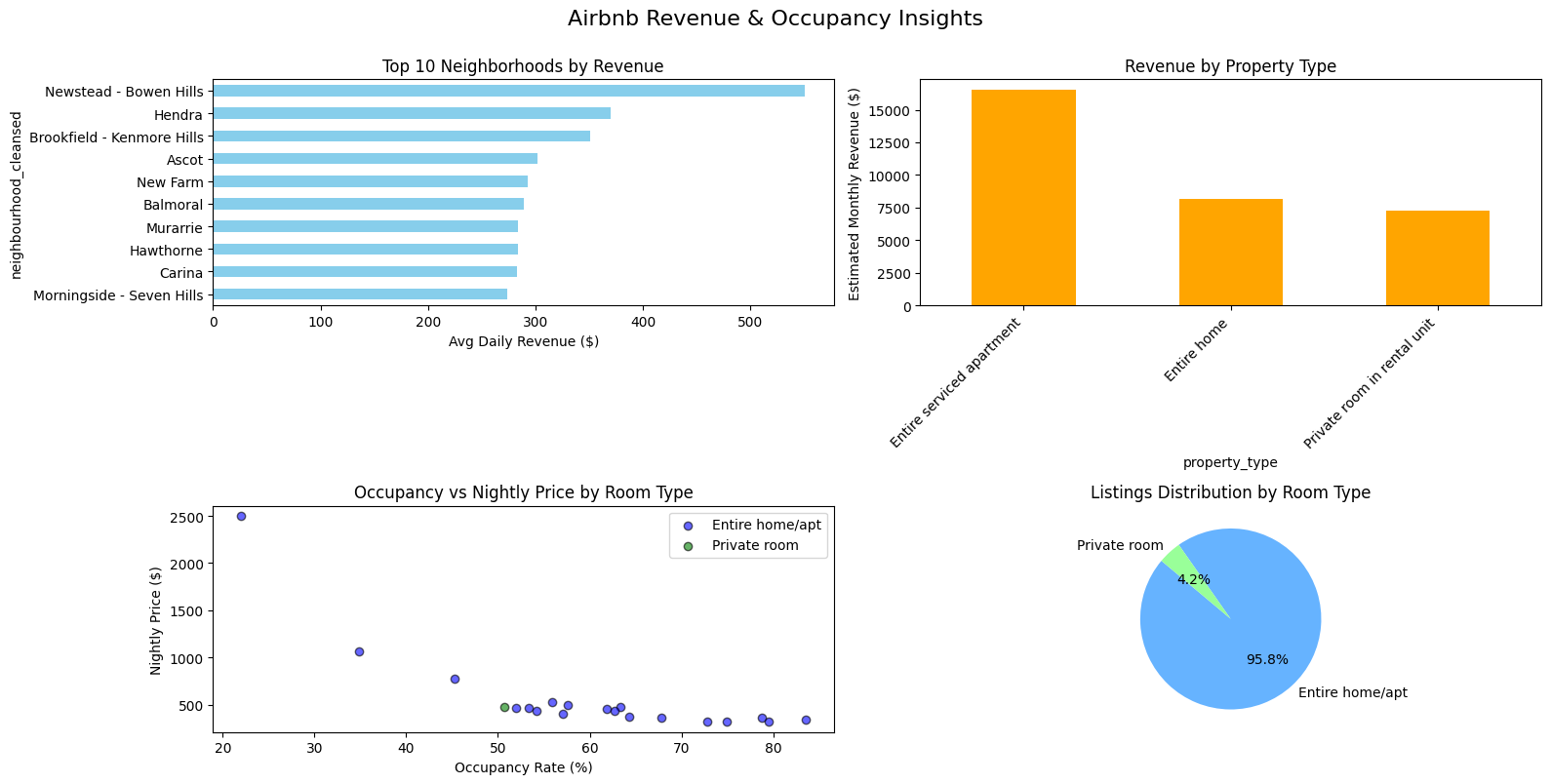

Top Earning Neighborhoods (Horizontal Bar Chart)

The analysis reveals a significant disparity in earnings across neighborhoods. Newstead - Bowen Hills stands out as the highest-earning area, generating an average daily revenue of over $500 per listing. This is substantially higher than other leading neighborhoods like Hendra and Brookfield - Kenmore Hills, which fall between $350 and $400.

Most Profitable Property Types (Bar Chart)

Entire serviced apartments are in a class of their own, with an estimated monthly revenue exceeding $16,000. This is more than double the revenue of the next most profitable category, "Entire home," which earns approximately $8,000 per month.

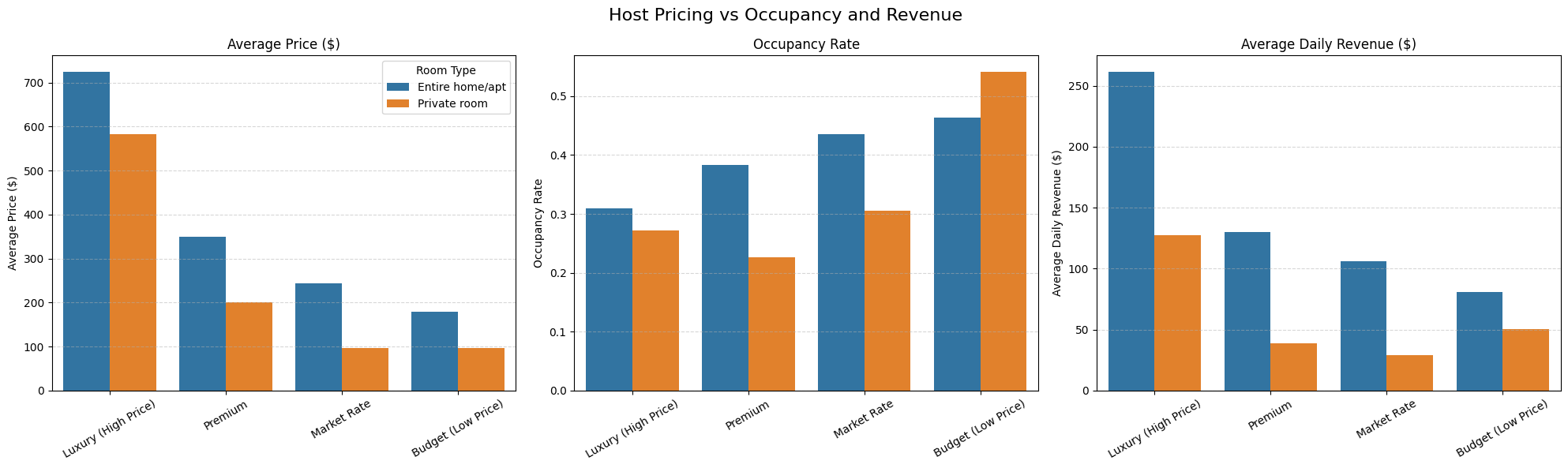

Occupancy vs. Price (Scatter Plot)

The scatter plot clearly shows that Entire home/apt listings (blue dots) have a wide distribution, commanding prices from a few hundred to over $2,500, with occupancy rates ranging from 20% to over 80%. In contrast, Private rooms (green dots) are clustered at a much lower price point (under $500) and have a narrower occupancy band, suggesting a price ceiling for this category.

In-Depth: Market Dominance (Pie Chart)

The pie chart illustrates a near-monopoly in the market's structure. Entire home/apt listings constitute a staggering 95.8% of the available properties in this analysis. This isn't just a majority; it signifies that for this city, the "Entire home/apt" is the quintessential Airbnb product. "Private room" listings make up a mere 4.2%, positioning them as a niche offering rather than a primary competitor. This dominance dictates guest expectations and the fundamental business model for hosts in this market.

Strategic Takeaway for Airbnb

Based on this data, I recommend Airbnb's corporate strategy should be two-fold:

1. Amplify the Core Product

Since Entire homes/apartments define the market, Airbnb should double down. This means creating marketing campaigns specifically showcasing these property types, developing host-education resources focused on optimizing entire homes, and featuring them more prominently in search results.

2. Targeted Growth

The data provides a clear map for resource allocation. Host acquisition teams should be deployed to Newstead - Bowen Hills and other top-performing neighborhoods. Furthermore, the exceptional revenue from "serviced apartments" indicates a lucrative sub-market that Airbnb could formally recognize with a dedicated search filter or a partnership program with property management companies.